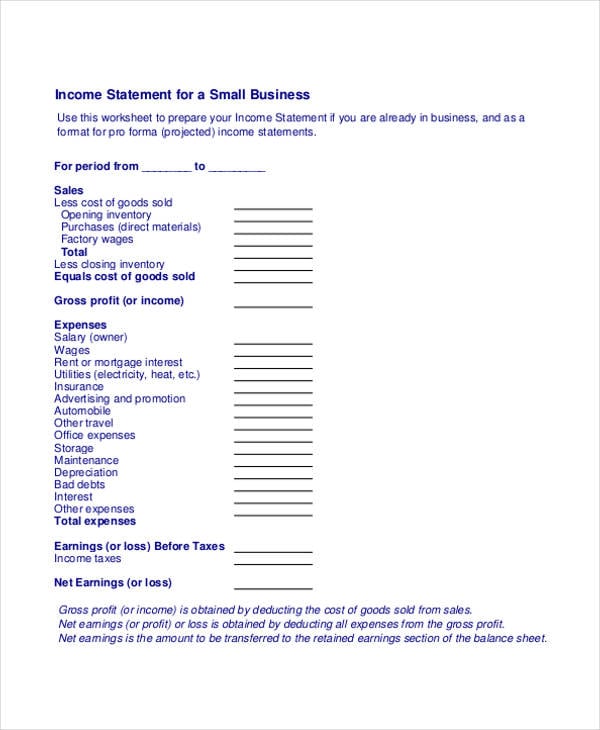

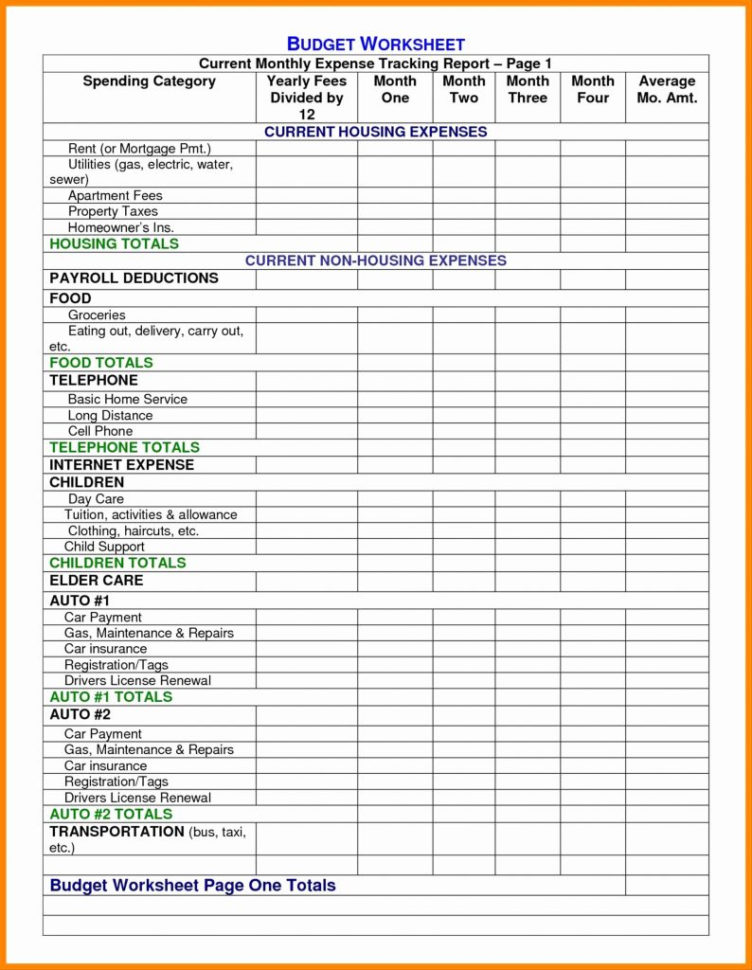

To learn more, read our complete guide to small business accounting 💡 Armed with this knowledge, you’ll be able to make more informed decisions on the type of accounting method that works best for your business, as well as how to set up a healthy bookkeeping, accounting and invoicing system. Top Tip: Understanding small business accounting is a crucial part of mastering how to track and organise your business expenses. Non-operating expenses may or may not apply to your small business depending on your specific situation.Ĭapital expenses, or CAPEX, are costs incurred by a business to acquire, maintain, or improve its fixed assets.Ĭapital expenses are largely incurred when a business undertakes a new project or invests in improving its processes and future output. Non-operating expenses are costs that aren’t related to the core operations of your business but are still incurred on a per-need basis.Įxamples of non-operating expenses include: Top Tip: To learn more about the accounting period and the important deadlines you need to be aware of, read our guide highlighting 3 top tips to keeping track of small business expenses ✅ The more items a company produces, the higher its COGS would be.īoth types of operating expenses are usually paid off in the same accounting period in which they’re incurred. These costs usually fall under a company’s overheads.ĬOGS are directly related to the production level of a business. SG&A expenses are the non-production costs incurred by a company.

The good news is, it is easy to implement efficient expense tracking to minimise such issues. More than half of small business owners have experienced cash flow problems, and expenses are one of the biggest factors in your cash flow equation.

For small business owners, learning how to effectively manage your expenses is crucial to your business’s financial health.

0 kommentar(er)

0 kommentar(er)